Tax return preparers should prepare for the upcoming 2020 tax filing season by renewing their Preparer Tax Identification Numbers now. All current PTINs will expire Dec. 31, 2019.

“Last year we issued more than 813,000 PTIN’s and are asking tax preparers to renew now to avoid a last-minute rush,” said IRS Return Preparer Office Director Carol Campbell. “Having this essential element done now will make the transition to tax season much easier.”

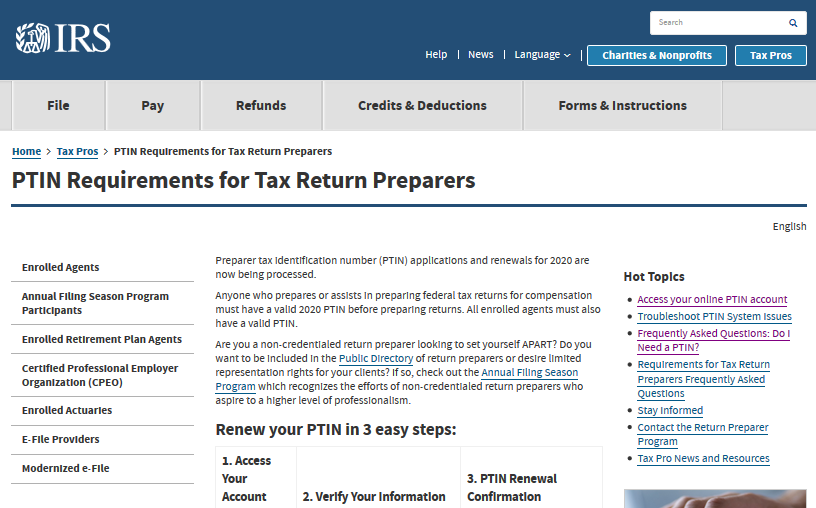

Anyone who prepares or helps prepare a federal tax return for compensation must have a valid PTIN from the IRS before preparing returns, and they need to include the PTIN as the identifying number on any return filed with the IRS.

Tax preparers with a 2019 PTIN should use the online renewal process, which takes about 15 minutes to complete. Form W-12, along with the instructions, provides a paper option for PTIN applications and renewals. However, it can take four to six weeks to process. Failure to have and use a valid PTIN may result in penalties.

To renew a PTIN online:

- Start at IRS.gov/tax-professionals.

- Select the “Renew or Register” button.

- Enter the user ID and password to login to the online PTIN account.

- Follow the prompts to verify information and answer a few questions.

Once completed, users will receive confirmation of their PTIN renewal. There is no fee for renewing or obtaining a PTIN for 2020.

The online system not only allows PTIN renewal, but can also be used by tax preparers to view continuing education credits, see a summary of the number of returns their PTIN has appeared on in the current year, and receive communications through a secure mailbox from the IRS Return Preparer Office.

First time PTIN applicants can also apply for a PTIN online.

To apply for a PTIN online:

- Start at IRS.gov/tax-professionals.

- Select the “Renew or Register” button and select “Create Account” in the New User box.

- First time users are issued a temporary password and will be prompted to change their password upon logging in.

- Select “Sign Up with SSN” once logged in.

- Follow the prompts to obtain the PTIN online.

Opportunity for non-credentialed tax preparers

The Annual Filing Season Program is a voluntary IRS program intended to encourage non-credentialed tax return preparers to take continuing education courses to increase their knowledge and improve their filing season readiness.

Those who choose to participate must renew their PTIN, complete 18 hours of continuing education and consent to adhere to specific obligations in Circular 230 by Dec. 31, 2019. The IRS has a video available on how to sign the Circular 230 consent and print the Record of Completion.

After completing the steps, the return preparer receives an Annual Filing Season Program Record of Completion from the IRS. Program participants are then included in a public directory of return preparers with credentials and select qualifications on the IRS website.

The searchable IRS directory helps taxpayers find preparers in their area who have completed the program or hold professional credentials recognized by the IRS.

Enrolled agent credential

The enrolled agent credential is an elite certification issued by the IRS to tax professionals who demonstrate special competence in federal tax planning, individual and business tax return preparation and representation matters. Enrolled agents have unlimited representation rights, allowing them to represent any client before the IRS on any tax matter.

As non-credentialed return preparers think about next steps in their professional career, the IRS encourages them to consider becoming an enrolled agent.

All enrolled agents, regardless of whether they prepare returns, must renew their PTIN annually in order to maintain their active status.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs